Dollar Tree: Destination During Recessions (NASDAQ:DLTR)

Mario Tama/Getty Images News

Introduction

Judging from the inventory market’s 2022 selling price motion, we are plainly either in a development scare or an outright recession. In either situation, the existing investment decision atmosphere has develop into much more demanding for prolonged-only buyers considering that the Fed created a pivot in their monetary coverage outlook in November 2021.

If we are in truth going through future financial turmoil, then placing Greenback Tree (NASDAQ:DLTR) on your watchlist to recognize the paying behavior of buyers may possibly verify to be a highly effective way to have an understanding of in the vicinity of-term consumption styles, which drive approximately 70% of the U.S. economic climate.

For me individually, although I am not as bullish on Greenback Tree as I am on Costco thanks to Costco’s a lot more stable business enterprise design, I do consider Greenback Tree’s counter-cyclical attributes can potentially permit investors to cut down portfolio beta even though continue to giving upside likely.

I believe Target’s (TGT) current earnings quarter has grouped all of retail stocks into 1 group, but traders really should bear in mind that DLTR is a price cut retailer and has absolutely unique consumer bases in contrast to that of Goal.

A fast corporation summary

To make sure our buddies below on Seeking Alpha are on the exact same site with Greenback Tree, I am likely to supply a pretty brief summary of their business model in situation you are not familiar with the business.

If you’ve got ever noticed retailers named Dollar Tree or Relatives Greenback (and there are 16,000+ of them in the U.S.), these are the suppliers owned by the Greenback Tree family of models. The corporation serves individuals from all profits levels, but particularly competes as a discount retailer with most merchandise sold staying priced underneath $10.

The small business model powering Dollar Tree

To fully grasp Greenback Tree, we have to have to individually fully grasp the small business products powering Dollar Tree – the retailer – and also Family Dollar the store.

At Dollar Tree merchants, most of the items in their merchants are now priced at $1.25 for every product. Dollar Tree has also partnered with Instacart where consumers can get exact same-day shipping. In phrases of wherever Greenback Tree resources their goods, in accordance to their 10K, they buy approximately 60% of their things domestically and imports the remaining 40% from countries outside the U.S. these kinds of as China. The items mix normally incorporates consumable, variable, and seasonal items.

In contrast to the Dollar Tree stores, Family members Dollar sells products that vary from $1 to $10 and have merchandise ranging from consumables, residence items, clothing & components, and seasonal/electronics items.

As price cut suppliers Dollar Tree and Spouse and children Greenback shops focus very seriously on consumable goods at decrease value details, and in my view, are not able to be adequately geared up to the consumer base that Focus on appeals to.

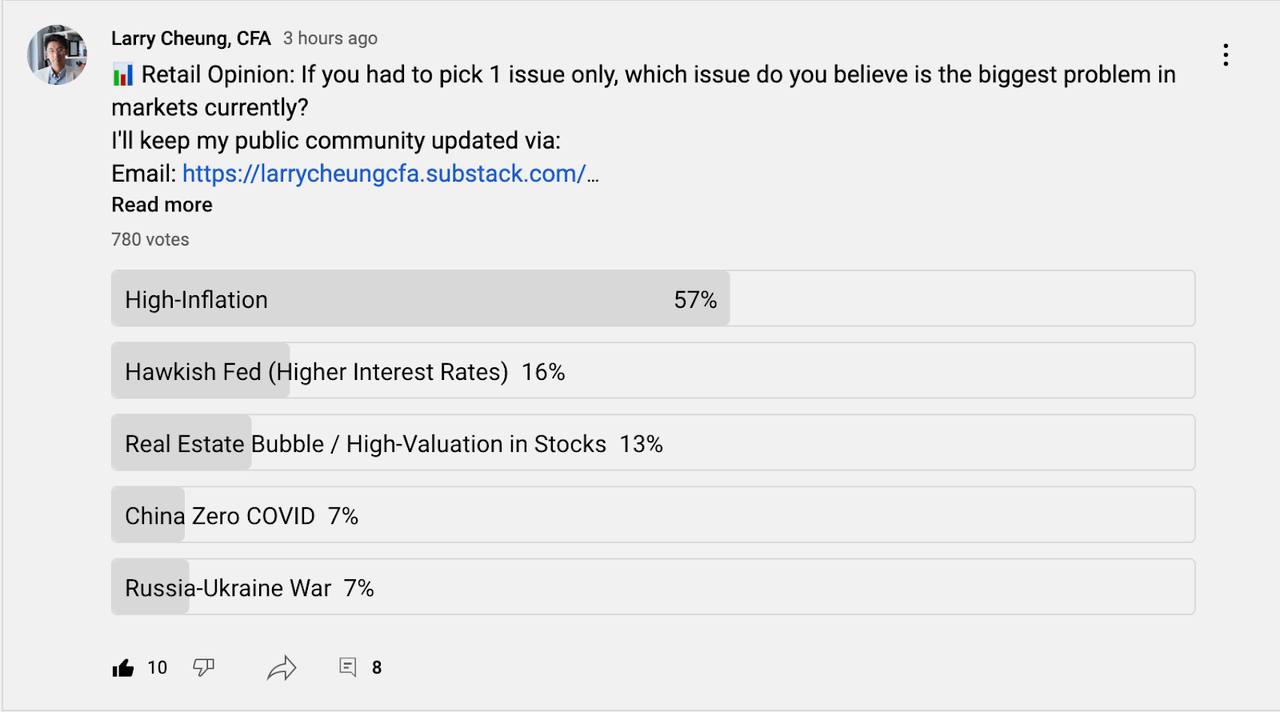

What drives Dollar Tree’s identical-keep-sales model and outlook

To understand what has been driving Greenback Tree’s shoppers in the earlier 18 months, I would objectively say that we need to concentrate on the recent gasoline rates at the pump, the career market place outlook, as well as the forecast for inflation. I not long ago ran a poll on YouTube to realize my audience’s greatest problem with the sector, and the remedy was higher inflation. If high inflation is indeed the premier challenge amid current market individuals, Dollar Tree’s defensive positioning in the marketplace-position must provide as an efficient hedge as people seek out greater promotions to extend their funds as much as doable. This poll had only been up for 3 hours.

YouTube

Offered that Greenback Tree is a discounted retailer, a lot of of their consumer demographics would much more acutely feel the pinch of greater transportation expenses by way of larger fuel costs. As a consequence, Greenback Tree Management has talked about in the earlier on their earnings phone calls back again through the money disaster that just after a certain threshold of gas costs, their goal consumers start to make less outings to the shop thanks to the higher value of transportation. The offset to bigger transportation expenditures is that Greenback Tree has quite a few of its merchants positioned in nearby neighborhoods where individuals can far more effortlessly stroll to. That reported, increased strength prices are heading to take in up any discretionary spending profits that Dollar Tree’s purchaser base most most likely has left. So strategic places in area neighborhoods may or could not offset the potent distress that buyers experience thanks to higher gasoline prices.

In this present-day financial climate where by fuel price ranges are large and general inflation is also higher, Greenback Tree’s business enterprise design is likely to carry on to draw in far more clients outside the house of their typical focus on marketplace. We can surmise this mainly because Goal lately claimed that many of their individuals have been buying a lot more very low-margin items (also reduced priced items). On the other hand, Greenback Tree is not immune to a big-scale pullback in purchaser spending wherever mixture expending is lowered to account for work protection stress and anxiety or a person’s career outlook. So when Greenback Tree will complete very well when the overall economy is gentle, it are unable to be expected to continue to supply sturdy same-retailer-revenue if the financial state is in a important disaster.

For this reason, it really is ideal to imagine about DLTR as a identify that does complete somewhat perfectly when the overall economy goes by means of a momentary small-term expansion scare, but if the economy enters a prolonged deep recession, then their concentrate on market place clients will have even less assets to spend on merchandise and expert services. A primary illustration of this is that Dollar Tree was even now hurt all through the 2008 money crisis.

The hazards to take into account

Greenback Tree’s gross margins have traditionally ranged in near the 30% stage. I believe that the Road will be hyper concentrated in evaluating whether or not transport expenses, wage improves, and other supply chain disruptions will impact DLTR’s gross margins.

Specified that China is a big resource of Dollar Tree’s imports, monitoring Biden’s policy on reducing trade tariffs will also be significant. I consider Dollar Tree will see more robust gross margins if Biden were to carry tariffs placed on China.

Greenback Tree currently trades at its 15Y normal forward several of roughly 17.5X. DLTR’s valuation multiple contracted sharply right after Target’s new earnings report that despatched the overall retail field and the shopper discretionary ETF XLY down. In this surroundings, Greenback Tree’s a number of is at a slight quality in comparison to the SPX, but that top quality is most probably justified since of its counter-cyclical defensive positioning. Essentially speaking, we will surely see additional individuals store at Greenback Tree due to high inflation and a weak financial outlook.

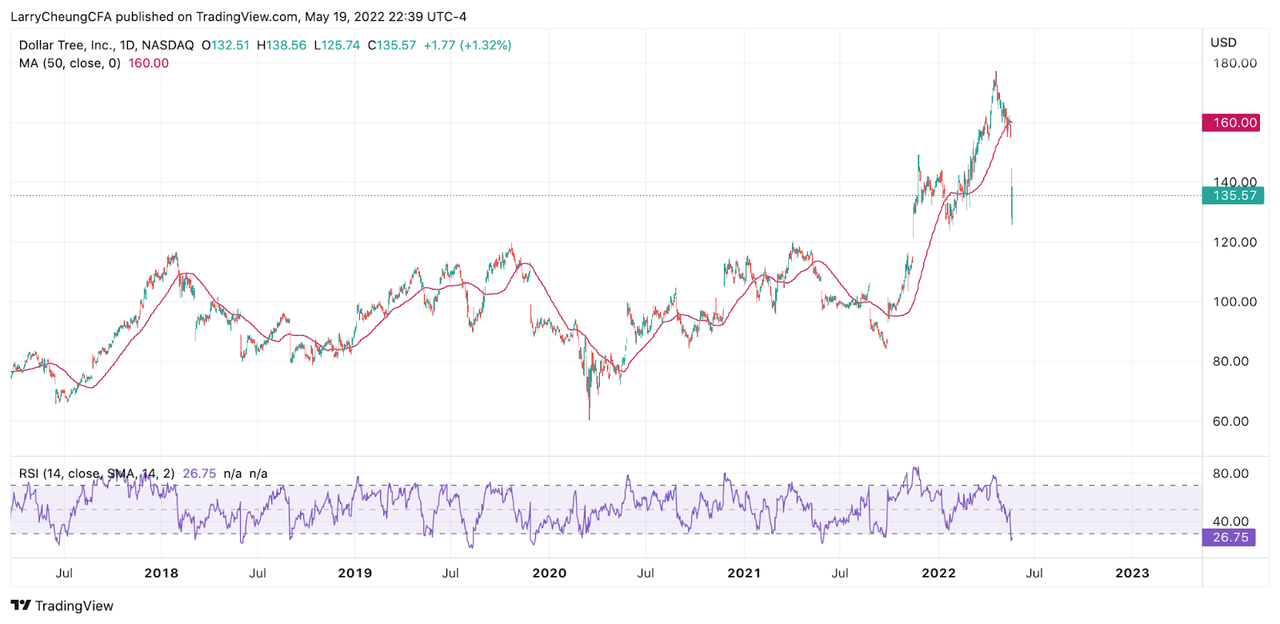

On a technological stage, soon after the most current selloff encouraged by Goal, Dollar Tree’s RSI is exhibiting a reading of 26 (in which 30 reads oversold) just after the business fell 20% in sympathy with the retail sector. In the earlier, these an oversold studying on DLTR has historically resulted in lengthier-phrase goal entries.

Dollar Tree Charts (Buying and selling Watch)

Dollar Tree reports earnings upcoming week, and my exploration report is by no indicates suggesting that my audience consider a situation ahead of earnings supplied that significant swings will occur following they report. Walmart (WMT) and Focus on are reminders that the retail sector is experiencing headwinds because of to the present ecosystem we are in.

Having said that, I do imagine that unless of course DLTR’s earnings report signifies sharply contracting margins, Dollar Tree’s fundamental setup and its positioning in this macro backdrop as nicely as its complex positioning present a motive to potentially examine a very light commencing posture in this title (earnings report apart).

I carry on to think that Dollar Tree is essentially distinct from Walmart and Goal and even Costco. For that reason, while the field-wide sentiment on retail is very fragile, it truly is unfair to team Dollar Tree (and Greenback Basic) in the same bucket as Walmart and Concentrate on provided their diverse business enterprise types, buyer bases, and exceptional development possibilities.

TGT and WMT might have let down the Street, but that does not assurance that DLTR fulfills the similar fate post-earnings given the financial environment we are now in.